This is one of the most common questions which is asked during uncertain economic times and here is an algorithm for you to make it easier for you to make up your mind.

- Are you paying rent ? If the mortgage payment is smaller or equal to your rent payment then buy.

- When buying don’t overpay and try to find a good deal. Think what might be in demand in 10-20 years so the property would be in demand if you need to sell in the future. Here are some hints:

- Aging population. Some areas can be in a slow decline without many work options or inflow of new citizens

- If the house that you are buying is not new or fully renovated it will need investment or it might lose value and not be in demand after 10 more years

- Heating & cooling and are they using economical energy sources : gas, electricity, central heating, solar panels etc.

- Food,water and the ecology in your area today and what is the trend

- Residential real estate as a way to preserve wealth.

Although during economic downturns the residential real estate can lose some of its value especially in areas where there has been a lot of real estate speculation, during a longer period of 10-20 years it gains in value as people need a place to live. In Estonia the level of speculative residential real estate purchases is low as banks will finance the purchase of residential properties only to people who work and live here.

- Real estate, inflation and how money goes into circulation:

As in most modern economies money is “printed/goes into circulation” at the moment when a loan is taken out so inflation and real estate prices are generally correlated so in the long run it is bound to increase in price.

- Political and tax situation. Look into how stable is the political and tax situation in your area and does it attract or repel people. In Estonia the tax law is favorable as: “If a person transfers a dwelling, which he or she used until the transfer as his or her place of residence, the gains derived from the transfer are exempt from tax and income tax is not charged.” Estonian Tax and Customs Board

- Geopolitical situation. Look for any crazy neighboring countries with bad intentions towards your country.

- AirBnB’s and other short term rentals in your area. If there are too many of them in your area there is a risk that if some legislation changes are made they will flood the market and drive both selling prices and rental prices down. In Tallinn there are currently around 2200 active listings in Airbnb according to https://airbtics.com/annual-airbnb-revenue-in-tallinn-estonia/ for comparison in the long term rental market the active monthly listings fluctuate from 1400 to 1900 listings.

- Jobs in your area. More jobs more people higher real estate prices

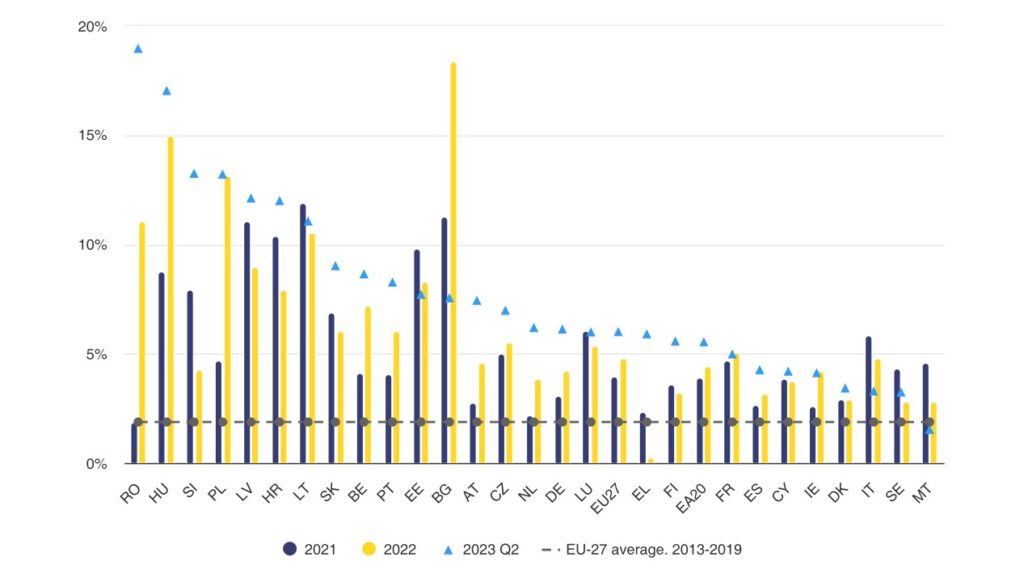

- Real estate prices and salaries in your neighboring countries. Estonia is in the EU and there is a tendency of salaries and real estate prices to equalize between old and new member states.