I start with basic calculation as in 2022 and build up to 2023 so for the verdict scroll down

Buying a property in Tallinn:

- Home Price: Let’s assume the average home price in Tallinn is €200,000.

- Down Payment: A common down payment is around 20%, so that would be €40,000.

- Mortgage Rate: Assuming a mortgage rate of 2% (roughly the rate in 2022 in Estonia), you would finance €160,000.

- Monthly Mortgage Payment: This could be around €680 per month (excluding property taxes and insurance).

- Property Taxes and Insurance:

- There is no property tax in Estonia there is only land tax and the land under your primary residence is exempt of taxes (https://www.emta.ee/en/private-client/taxes-and-payment/other-taxes/land-tax#tax-liability)

- Property insurance will be around 200 EUR a year so 17 EUR/month

Renting a property in Tallinn:

- Monthly Rent: Assume the average rent for a similar property is €800 per month.

- Security Deposit: Often, renters pay a security deposit equal to one month’s rent, so €800.

Comparison Renting VS Buying:

- Upfront Costs:

- Buying: €40,000 (down payment) + closing costs (around 600 EUR).

- Renting: €800 (security deposit).

- Monthly Costs:

- Buying: €697 (mortgage + property taxes + insurance).

- Renting: €800.

Considerations:

- Equity Buildup:

- Buying allows you to build equity over time, whereas renting does not offer this benefit.

- Flexibility:

- Renting provides more flexibility if you anticipate moving in the near future.

- Market Appreciation:

- If the property appreciates in value, buying can provide a financial return.

- Maintenance Costs:

- Homeownership may involve additional costs for maintenance and repairs.

This simplified example illustrates the importance of considering upfront costs, monthly expenses, and long-term goals.

Buying vs renting in Tallinn & Estonia in 2023

The current interest rate in November 2023 is 6 % (Estonia Bank Lending Rate was reported at 6.390 % pa in Aug 2023) so the mortgage monthly payment for the same loan with 6.3 % interest will be 1 060 EUR

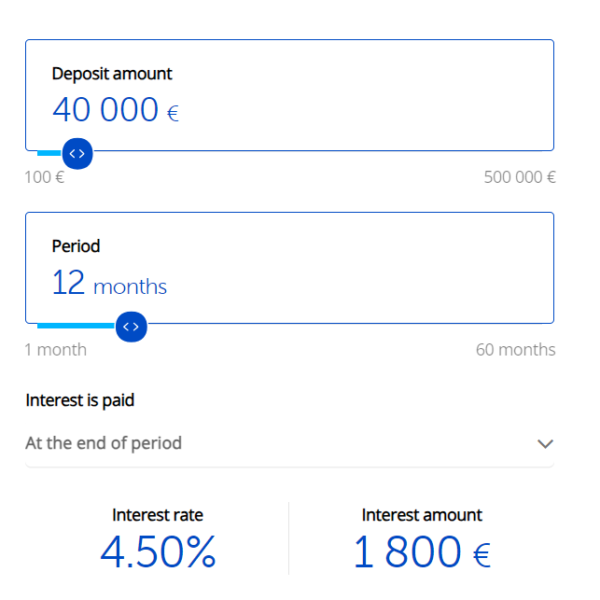

The interest rates on the deposits have also increased and you can get 4.5 % easily so by paying 40 000 EUR down on your mortgage you have an opportunity cost of 1800 EUR/year which is 150 EUR/month so your buying costs are actually 1060 +150=1210 EUR/month

In 2023 the rents have decreased 10-20% compared to 2022 so renting the same apartment will cost 640 EUR/month so the cost to buy a property in Tallinn with a mortgage is almost double than to rent in 2023

The verdict is that buying a property in Tallinn, Estonia with a mortgage in 2023 at the current prices does not make sense and you will be better off renting. If you don’t need a mortgage this is a good opportunity for you to negotiate and get some very unique properties.

Consultation with Estonian real estate professionals and financial advisors is highly recommended for accurate and personalized advice.

Author: Georgi Zanev